How To Apply SSS Loan — Are you skeptical about the SSS Salary loan and wondering if it’s the right choice for you? Well, let’s take a closer look and consider the other side of the coin. In this blog post, we’ll explore the potential drawbacks and limitations of the SSS Salary loan. From strict eligibility criteria to potential repayment challenges, we’ll address the concerns you may have. It’s important to have a balanced perspective when making financial decisions, so read on to gain a deeper understanding of the potential downsides of the SSS Salary loan.

What is SSS Loan or SSS Salary Loan?

The salary loan offered by the Social Security System (SSS) serves as a valuable resource for employed members and voluntary contributors who find themselves in need of immediate financial assistance. This type of loan acts as a cash advance, aiding individuals in meeting their short-term monetary requirements.

By availing themselves of this service, eligible SSS members can address pressing financial concerns, such as unexpected expenses or urgent bills. The salary loan serves as a practical solution, providing relief and support during challenging times.

Benefits of SSS Loan

Here are the benefits of the salary loan provided by the Social Security System (SSS):

Financial Assistance – The salary loan serves as a valuable source of financial support for qualified employed members and currently-paying voluntary members of the SSS. It offers a convenient and accessible way to address short-term monetary needs, providing individuals with the necessary funds when they require immediate assistance.

Quick and Convenient – The SSS loan online application process is designed to be efficient and user-friendly. Members can easily apply for the loan through the SSS website or their nearest SSS branch (How To Apply SSS Loan). The streamlined procedures ensure a hassle-free experience, allowing borrowers to obtain the funds they need in a timely manner.

Competitive Interest Rates – The SSS offers salary loans at competitive interest rates, making it an affordable option for borrowers. The lower interest rates compared to other types of loans help minimize the financial burden on borrowers and facilitate easier repayment.

Flexible Repayment Terms – Borrowers have the flexibility to choose from various repayment options based on their financial capacity. The SSS offers reasonable repayment terms, allowing borrowers to manage their loan (loan online sss) obligations effectively without straining their monthly budget.

Who can Apply for SSS Loan?

To be eligible for the SSS salary loan offered by SSS, members must meet the following eligibility criteria or requirements (SSS loan requirements), which are as follows:

1. The applicant must be under 65 years old at the time of loan application. This age limit ensures that the loan is accessible to individuals within a specified working age range.

2. The applicant must be a regular paying SSS member, which includes employed individuals, those who are currently contributing, self-employed individuals, or voluntary contributors.

To qualify for a one-month loan, the member should have made 36 monthly contributions, with at least 6 contributions made within the last 12 months prior to the month of SSS Loan Online Application (loan online sss).

For a two-month loan, the member must have made 72 monthly contributions, with 6 contributions made within the last 12 months before the month of application.

3. The applicant’s SSS Contribution must be up to date. If the applicant is employed, it is necessary for the employer to be up to date with payment of contributions and loan remittances to the SSS. This requirement ensures that employers fulfill their obligations and guarantees a smooth loan application process for the member.

4. The applicant should not have availed themselves of any of the final benefits (one great example is Retirement Benefits) provided by the SSS, which include death, retirement, and total permanent disability benefits. This requirement ensures that the salary loan is specifically intended for short-term financial needs rather than long-term benefits.

5. The applicant should not have been disqualified from availing SSS benefits due to fraudulent activities committed against the SSS. This criterion ensures that the loan facility is accessible to eligible and trustworthy individuals.

By meeting these eligibility requirements (SSS Loan Requirements), SSS members can avail themselves of the salary loan facility to address their immediate financial needs in a responsible and efficient manner.

How much can I borrow from SSS?

When applying for a salary loan from SSS, the loan amount is based on your Monthly Salary Credit (MSC) and the length of your contributions.

If you have consistently contributed for at least 36 months, you can qualify for a one-month salary loan. The loan amount is determined by calculating the average of your 12 most recent MSCs. It is then rounded up to the nearest higher MSC or the requested amount, whichever is lower.

For example, assuming your MSC is Php25,000. If the average of your 12 most recent MSCs is Php25,000, you can borrow up to Php25,000 (one-month loan) which is the maximum loanable amount for one month loan. Note that you can’t go beyond Php25,000.

If you have contributed for 72 months or more, you can qualify for a two-month salary loan. The loan amount is calculated as twice the average of your MSCs from the last 12 months. It is then rounded up to the nearest higher MSC or the requested amount, whichever is lower.

Using the same example with an MSC of Php25,000, if the average of your MSCs in the last 12 months is Php25,000, you can borrow up to Php50,000 for a two-month loan which is the maximum loanable amount.

How Much is the SSS Salary Loan Interest Rate?

As of 2023, the SSS salary loan interest rate is 10% per annum. This interest rate positions the SSS salary loan as one of the loans with the lowest rates in the Philippines. The interest is calculated based on the diminishing principal balance. This means that the interest will continue to be charged on the outstanding balance until the loan amount is fully repaid. It’s important to note that the interest rate may be subject to change based on any updates or revisions implemented by the SSS.

Upon approval of your salary loan application, it’s important to note that the actual loan amount disbursed to you will be subject to certain deductions. These deductions include an advance interest fee and a service fee equivalent to 1% of the loan amount. These amounts will be subtracted from the loan amount you requested, resulting in the actual amount you will receive. It’s essential to consider these deductions when planning your finances and determining the total funds available to you.

What Are the Requirements for SSS Salary Loans?

The process for obtaining an SSS salary loan has undergone changes according to SSS Circular 2019-014 titled Real Time Processing of SSS Loans. Now, SSS member / SSS Loans borrowers must apply for the SSS salary loan online, making the process more convenient and accessible.

To complete the SSS salary loan application, there are several requirements you need to fulfill. First and foremost, you must have a stable internet connection to access the online application platform.

Additionally, you’ll need to have a My.SSS account. If you haven’t registered for an account yet, don’t worry – you can follow a simple step-by-step guide to create SSS Online Inquiry Account.

Once you have an active My.SSS account, the next requirement is to choose a preferred electronic loan disbursement channel. It’s important to note that receiving loan proceeds via check is no longer an option as of 2021. However, there are alternative methods available for loan disbursement.

- One option is to enroll a PESONet – participating bank account within your My.SSS account. If you have an account with any PESONet-accredited bank, you can link it to receive your loan proceeds. Please keep in mind that joint accounts will not be accepted, so ensure that you are the sole account holder.

- Alternatively, if you don’t have a PESONet-accredited bank account, you can still receive your loan proceeds through various e-wallets, RTC (Real-Time Credit), or CPO (Cash Pick-up Outlets). Popular e-wallet options include GCash, PayMaya, DCPay Philippines, or DBP Cash Padala through M Lhuillier.

- For those who prefer an SSS-issued UBP Quick Card, it’s important to note that only UBP accounts not linked with other government offices, such as the Pag-IBIG Loyalty Card, are eligible. The UBP Quick Card numbers start with “10” and are comprised of 12 digits. To obtain a free UBP Quick Card, you can visit select SSS branches.

With the new online application process and various disbursement channels available, the SSS salary loan online has become more accessible to member-borrowers. By meeting the requirements and following the outlined procedures, individuals can easily apply for and receive their salary loans in a timely manner.

How to Apply for an SSS Salary Loan: A Step-by-Step Guide

If you’re looking to apply for an SSS loan, the process has become more convenient with the introduction of the SSS Member portal on the new SSS website. Here’s a step-by-step guide to help you navigate through the application process:

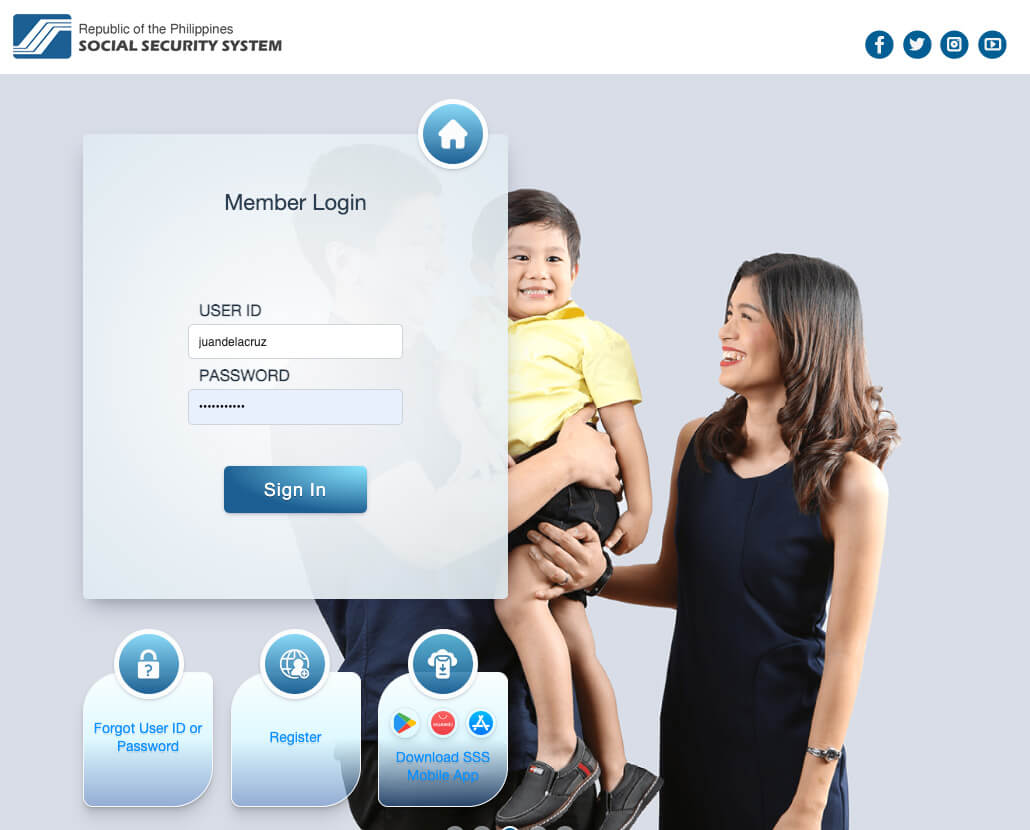

1. Start by visiting the new SSS website and accessing the SSS Member portal. Once you land on the page, don’t forget to tick the “I’m not a robot” box, and then click “Submit.”

2. Within the SSS portals, choose the “Member” option as you are an individually paying member. This will lead you to the SSS member login page.

3. Log in to your My.SSS account using your user ID and password and click “Submit.” In case you’ve forgotten your user ID or password.

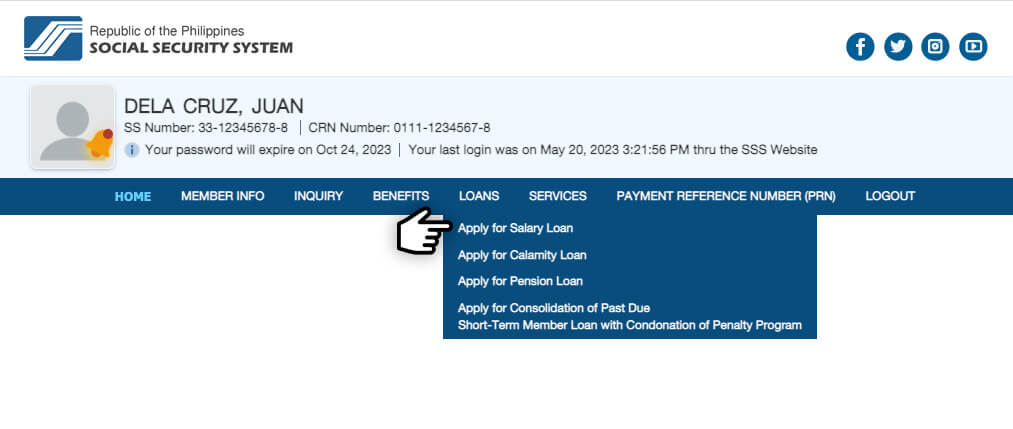

4. Once logged in, click on the “LOANS” tab and select “Apply for Salary Loan“.

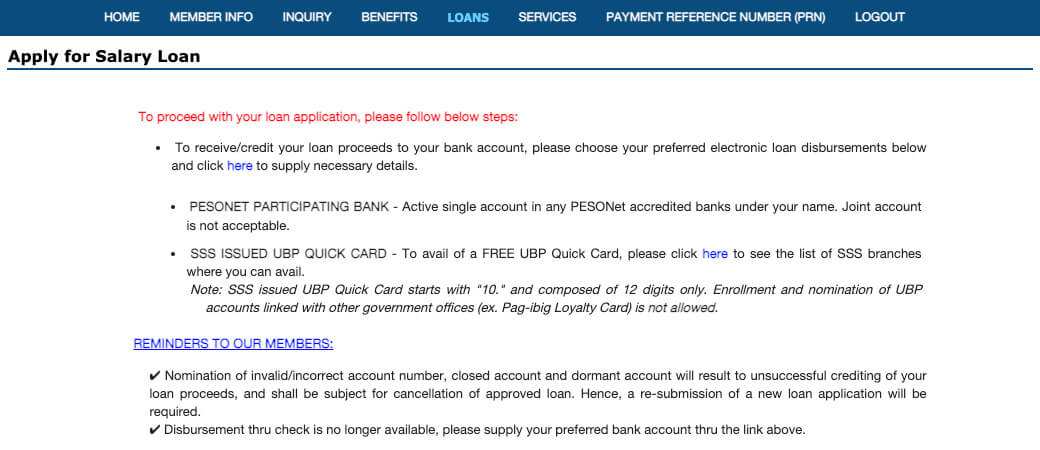

5. Choose your preferred electronic loan disbursement channel. As mentioned earlier, you have several options available: PESONet-participating bank, e-wallet/RTC/CPO, or SSS-issued UBP Quick Card. If you opt for the first two options, you can enroll your account by clicking the provided link. If you prefer the UBP Quick Card, visit one of the select SSS offices to process your application. Please note that loan disbursement via check is no longer available.

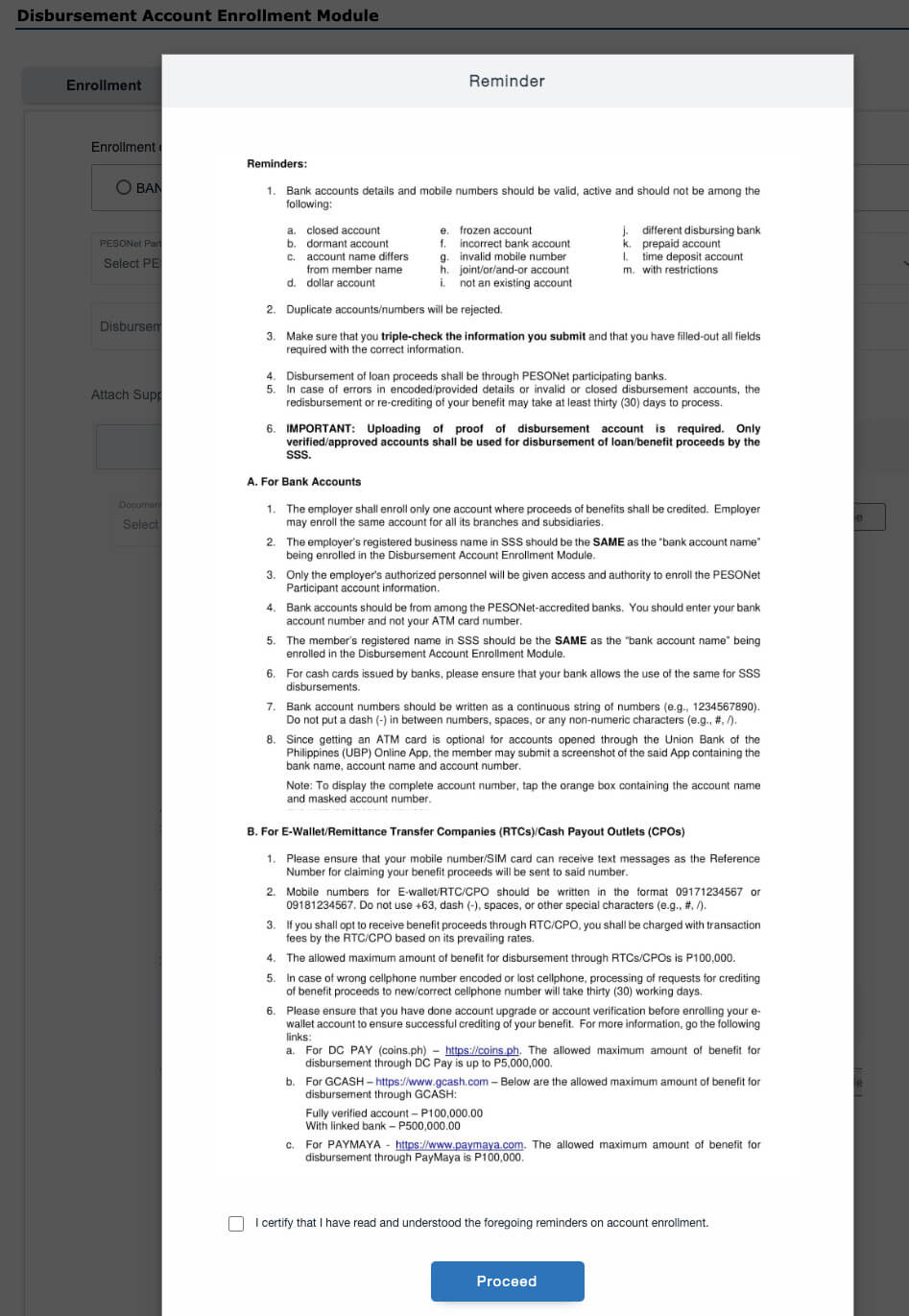

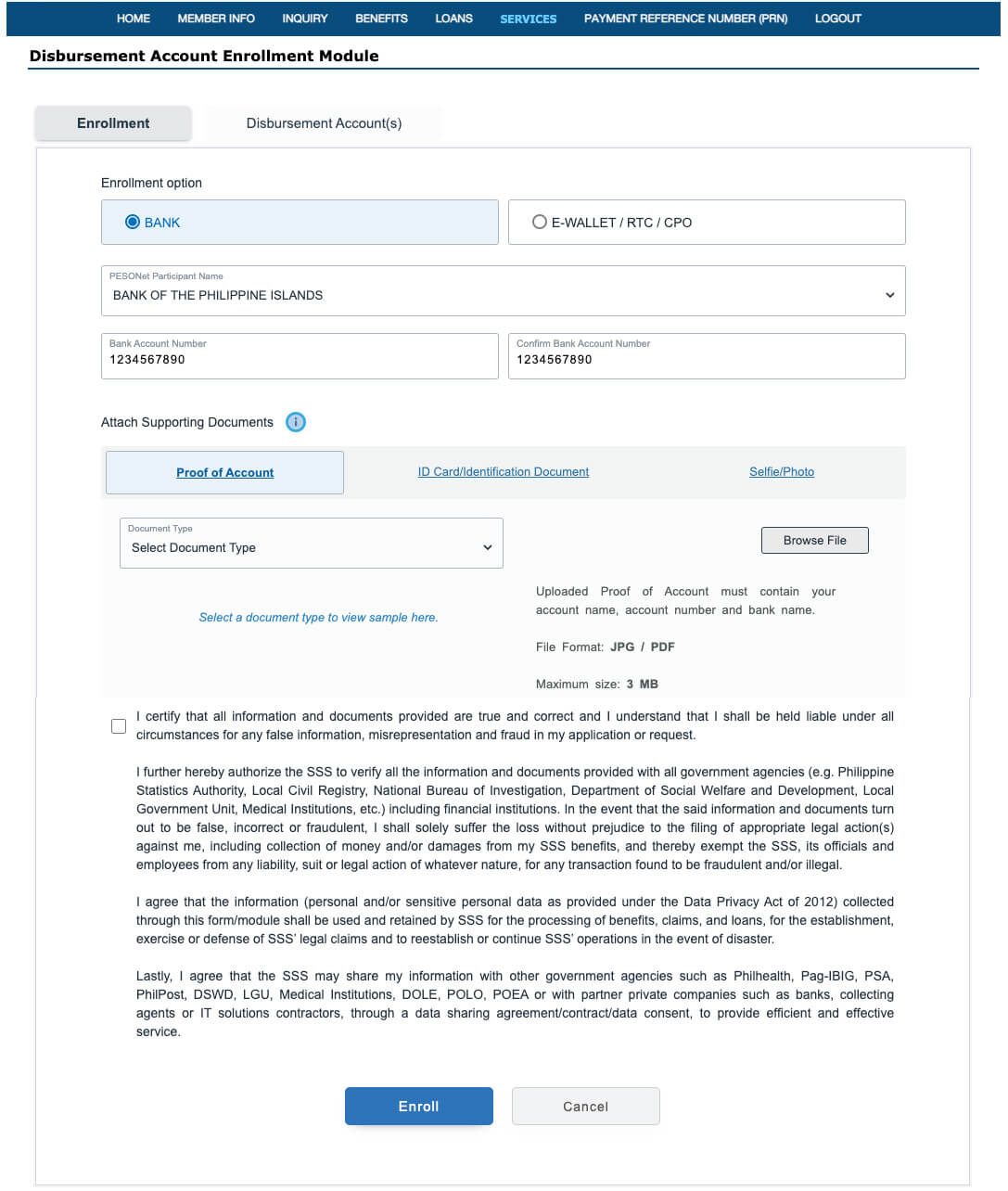

6. Take a moment to read the reminders related to the Disbursement Account Enrollment Module (DAEM). These reminders provide important information about the enrollment process for PESONet-accredited bank accounts or e-wallets. Once you’ve read and understood the reminders, tick the box to certify your understanding, and then click “Proceed.”

7. Proceed to enroll your bank account or mobile number using the Disbursement Account Enrollment Module. Provide the required details for your chosen disbursement channel and upload a supporting document containing your account name and number. For bank accounts, a screenshot of your online banking account dashboard displaying the necessary information is acceptable. If you’re enrolling an e-wallet account like GCash, provide a screenshot showing your complete name and account number. After entering the required information, tick the box permitting SSS to use your personal information, and click the “Enroll Disbursement Account” button.

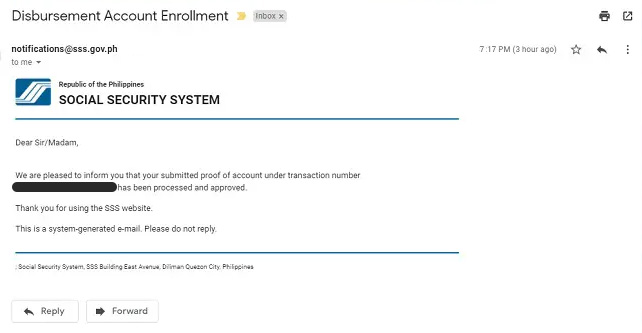

8. Wait for your Disbursement Account Enrollment to be approved. The servicing branch will review your submitted supporting documents and provide an update within 1 to 2 working days. If approved, you will receive an email and SMS notification confirming the approval of your proof of account.

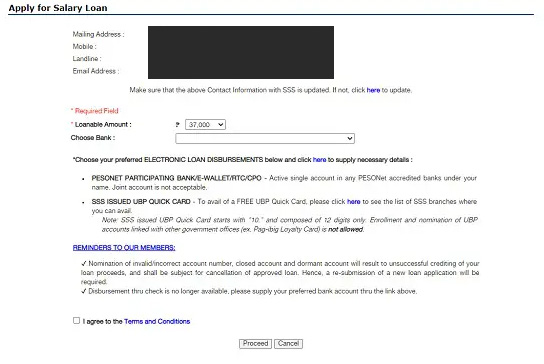

9. Now that your disbursement account has been approved, return to your My.SSS account and click on “Apply for Salary Loan” under E-SERVICES. Before proceeding, ensure that your mailing address, mobile number, landline, and email address are updated.

Select the desired amount of salary loan you need. The maximum loanable amount will be displayed automatically, but you can choose a smaller amount from the drop-down menu that meets your current needs. Next, choose the method of claiming the loan proceeds from your enrolled disbursement account.

After reading the provided reminders, check the box agreeing to the Terms and Conditions, and click “Proceed” to move on to the next step.

12. Take a moment to review the Loan Disclosure Statement, which provides a summary of essential information about your SSS salary loan, including net loan proceeds, the balance of any previous loan, monthly amortization, and the schedule of payment/due dates. Once you have reviewed the Loan Disclosure Statement and are satisfied with the details, click “Proceed.”

13. Review the “Certification, Agreement, and Promissory Note” and once you’ve read and understood the terms, click “Submit.”

Make sure to keep a copy of the transaction number for future reference. You will also receive a confirmation message with the same transaction number sent to your email address.

14. Now, you’ll need to wait for the notification regarding the status of your SSS salary loan application. The timeline differs depending on your employment status:

- For employees: Your employer will have three working days to certify (reject/approve) your salary loan. You will be notified via email or SMS regarding the status of your application once this step is completed.

- For separated, self-employed, OFW, and voluntary members: You will also receive an email or text notification informing you whether your loan application has been approved.

15. Finally, once the loan proceeds are ready, you can receive them through your preferred mode. Based on personal experiences, loan proceeds were credited to bank accounts within two days after receiving an email from SSS confirming the approval of the application.

Following these steps will help you navigate the application process for an SSS salary loan with ease. Remember to keep track of the updates and notifications provided by SSS to ensure a smooth and successful loan application.

Frequently Asked Questions

Here are some frequently asked questions to provide you with a better understanding of the SSS salary loan process:

How to apply for SSS loan for the first time?

If it’s your first time applying for an SSS loan, the application process is similar to the steps discussed above. The only difference is that as a first-time applicant, you don’t have an enrolled disbursement account yet, such as a bank account or e-wallet. During the application process, you will need to enroll your preferred disbursement account by providing the necessary details and supporting documents. This step is not required for subsequent loan applications once you have already enrolled a disbursement account.

How can I qualify for SSS loan?

To qualify for an SSS loan, you need to meet the eligibility criteria outlined in the “Who can Apply for SSS Loan?” section of this article. Please refer to that section for detailed information on the qualifications required to apply for an SSS loan.

How much is the first loan of SSS?

The exact amount of the first loan from SSS may vary depending on individual circumstances, but it is determined based on your Monthly Salary Credit and length of contribution. If you have contributed for at least 36 months (which is the requirement for all first time SSS Loan Applicants), you can qualify for a one-month salary loan.

To understand what “Monthly Salary Credit” means and determine which bracket you fall into, it is highly recommended to refer to the latest SSS Contribution Table. This table provides detailed information on the salary brackets and corresponding Monthly Salary Credits, allowing you to calculate your potential loan amount accurately.

How much can I borrow to SSS?

This question is the same as the question above “How much is the first loan of SSS”. The loanable amount from SSS depends on various factors, such as your Monthly Salary Credit and length of contribution. For first-time SSS loan applicants who have contributed for at least 36 months, they may qualify for a one-month salary loan.

You may refer to the question above for more details.

What is the interest rate for SSS salary loan?

As of 2023, the SSS salary loan interest rate is 10% per annum. In my opinion, this interest rate is quite competitive and advantageous for borrowers, as it is relatively low compared to other loan options available in the Philippines.

The interest is calculated based on the diminishing principal balance, which means that it gradually decreases as you repay the loan. This calculation method helps borrowers save money on interest payments over time. It’s important to note that the interest rate may be subject to change based on any updates or revisions implemented by the SSS. It’s always a good idea to stay informed about any changes in interest rates to make informed financial decisions.

How to apply SSS salary loan application online?

We have provided a step-by-step guide on how to apply for an SSS salary loan earlier in this article. Please refer to the guide above for detailed instructions on how to navigate the online application process.

It will walk you through accessing the SSS Member portal, logging into your My.SSS account, choosing the loan disbursement channel, enrolling your disbursement account, selecting the loan amount, reviewing the loan disclosure statement, and submitting your application. By following the guide, you can easily apply for an SSS salary loan online.

Who is qualified for an SSS loan?

SSS salary loans have specific eligibility criteria that applicants must meet in order to be approved. To provide an overview, the applicant must be under 65 years old and a regular paying SSS member. It is essential that the applicant’s SSS contributions are up to date. Additionally, the applicant should not have availed themselves of any final benefits, and they should not have been disqualified from accessing SSS benefits due to fraud. Meeting these requirements is crucial for determining eligibility for an SSS salary loan.

How many days will it take to receive my SSS salary loan?

In my personal experience, it took 2 working days before the SSS salary loan proceeds were credited or deposited to the enrolled account. However, please note that the processing time may vary depending on factors such as the disbursement channel (Bank or Ewallet).

How is SSS loanable amount calculated?

Answer: When applying for a salary loan from SSS, the loan amount is based on your Monthly Salary Credit (MSC) and the length of your contributions. The calculation of the loanable amount follows specific guidelines.

For SSS members who have consistently contributed for at least 36 months, a one-month salary loan is available. The loan amount is determined by averaging your 12 most recent MSCs and rounding it up to the nearest higher MSC or the requested amount, whichever is lower. Let’s say your MSC is Php25,000, and the average of your 12 most recent MSCs is also Php25,000. In this case, you can borrow up to Php25,000, which is the maximum loanable amount for a one-month loan.

On the other hand, if you have contributed for 72 months or more, you qualify for a two-month salary loan. The loan amount is calculated as twice the average of your MSCs from the last 12 months, rounded up to the nearest higher MSC or the requested amount, whichever is lower. Using the same example with an MSC of Php25,000, if the average of your MSCs in the last 12 months is Php25,000, you can borrow up to Php50,000 for a two-month loan, which represents the maximum loanable amount.

It’s important to note that the loanable amount cannot exceed the specified limits based on your MSC and contribution length, ensuring fair and consistent loan calculations for SSS members.

How do I know if my employer approved my SSS salary loan?

If you are employed, the approval status of your SSS salary loan application will depend on your employer. They will be given three working days to certify (reject/approve) your loan request. Once this step is completed, you will receive a notification either via email or SMS informing you of the status of your application. It’s important to note that if your employer fails to take action within the given timeframe, it will result in automatic rejection of your loan application.

Can I use GCash for SSS salary loan disbursement?

Yes, of course! GCash is one of the allowed and popular disbursement channels used by SSS to send the loan proceeds to its members who have applied for an SSS loan. GCash provides a convenient and secure way to receive your loan funds directly into your digital wallet, allowing for easy access and immediate use. By choosing GCash as your disbursement channel, you can enjoy the flexibility and convenience of managing your SSS salary loan funds through a digital platform that is widely accessible and widely used.

What will happen if I cannot pay my SSS loan?

If you are unable to pay your SSS loan on the due date, it is important to be aware of the consequences. Failure to remit the loan amortization on time will result in a penalty of 1% per month until the loan is fully paid. It is crucial to prioritize timely payments to avoid accumulating additional charges and to ensure a smooth repayment process. If you are facing financial difficulties, it is advisable to reach out to the SSS and explore possible options for assistance or alternative payment arrangements. Taking proactive steps can help you manage your loan obligations effectively.

How can I check or view the status of my SSS salary loan application?

To check your SSS salary loan status, you can log in to your My.SSS account. Once logged in, navigate to the “Inquiry” section and select “Loan Info.” Within this section, you will find relevant information about your SSS loan, including its status and other loan details. Additionally, you can expect to receive a notification via SMS once the loan proceeds have been successfully credited to your designated disbursement account. This feature helps members stay updated and informed about the progress of their loan application, ensuring a smooth and transparent process.

I have an existing SSS loan. Can I still apply for an SSS salary loan?

Yes, under the guidelines set by the SSS, member-borrowers have the opportunity to renew their SSS salary loan under certain conditions. To be eligible for renewal, you must have paid at least 50% of the original principal amount and at least 12 months or 50% of the loan term must have lapsed. For instance, if you were granted a salary loan of PHP 40,000 on May 31, 2023, you can apply for another salary loan once your principal loan balance falls below PHP 20,000 which is the 50% of PHP 40,000. Additionally, the renewal date should be after June 2022. The proceeds of the renewal loan can be equal to or greater than zero, as long as the outstanding balance of your previous salary loan has been deducted from the new loan amount.

How To Check SSS Loan Balance

Checking your SSS loan balance is simple and convenient. All you need to do is log in to your SSS Online Inquiry Account and navigate to the “Loans Info” page. There, you will find the relevant information about your loan, including the outstanding balance. This online feature allows you to stay updated on your loan status and manage your finances effectively. You may be interested in reading our article about WWW.SSS.GOV.PH Loan Balance Inquiry

Do you need an SSS ID to apply for an SSS Loan?

No, SSS ID is not required in applying for an SSS Loan. If you are interested in applying for an SSS ID or UMID, you may be interested in our related blog post about the application of SSS ID (How To Apply SSS ID).